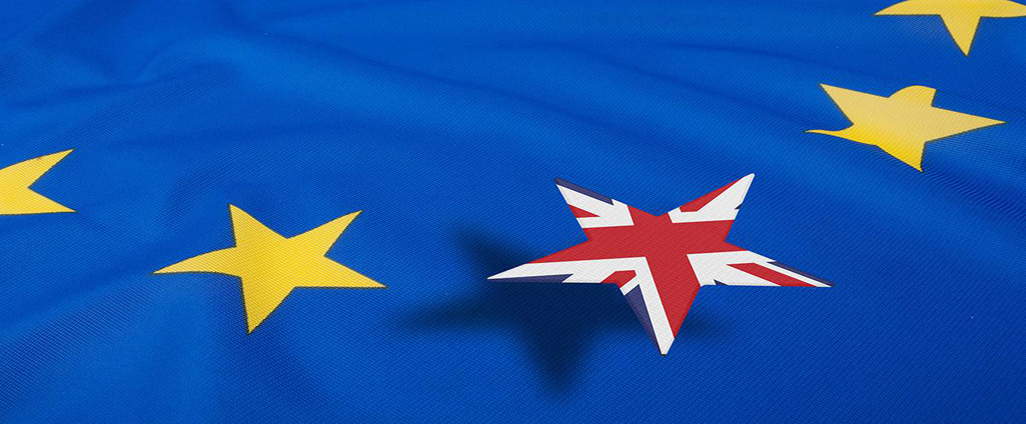

How would a ‘No Deal’ Brexit affect British Owners of Spanish Property?

An air of uncertainty continues around Britain as the country’s scheduled departure from the EU on 29th March 2019 looks set to possibly drift into delay. There has been contentious debate on all sides, and, despite Theresa May’s efforts, it is looking increasingly likely that the UK might leave the European Union without the elusive, favourable deal sought by politicians and Britain as a whole. There is still time of course for a deal to be agreed so fingers & toes crossed!

EU chiefs Jean-Claude Juncker and Donald Tusk were both adamant during the latest meetings this month that there should be no re-negotiation on the withdrawal agreement. The prospect of a ‘no deal’ brexit is likely to affect various aspects of life in the UK and, indeed, Europe, but how would it affect British owners of Spanish property?

Firstly, an important distinction must be drawn between Spanish residents and non-residents. Anyone living in Spain for more than 183 days a year has an obligation to submit a Spanish tax declaration the year after they arrive between May and June. If a UK national is a Spanish permanent resident, i.e, has lived in Spain for more than 183 days, has become a resident by registering with their local council authority before 29th March 2019 and has submitted a tax return, the rates for income and inheritance tax, on worldwide income and assets, is likely to remain unchanged.

Should there be a ‘No Deal’ Brexit, the Spanish government has made a pledge to British citizens by stating to: “provide a solution that in any event guarantees the legal security of British citizens and the members of their families resident in Spain before the exit date”

Investors looking to purchase a Spanish property as a second home and not intending to spend more than 183 days in Spain will be considered a Non-Spanish tax resident owner of Spanish property. As such, the buying costs will remain the same. Currently, an American buyer of Spanish property would pay the same purchase costs as say a French or British buyer. A year after purchasing a Spanish property, however, a non EU or EEA property owner would be liable to NRIT, a national tax on Spanish property ownership. (Non Resident Income Tax). This tax applies whether the property is rented out or not.

NRIT is calculated using a taxable base of the cadastral value of the property. The taxable base is 2% of the cadastral value of your property or 1.1% if the cadastral value was revised after the 1st of January 1994. This taxable base is then multiplied by the appropriate tax rate. Currently EU nationals pay 19% whilst non-EU owners of Spanish property pay 24%. If there is No Deal Brexit with the EU, British owners will, most probably, be liable for the higher rate of 24%.

No one can accurately predict what will happen in a post-Brexit Spanish property market but there are still many British owners who enjoy their dream home in Spain. Some of them have been around since Spain itself was not a member of the EU and have prospered despite many procedural changes over the years.

(picture courtesy of kyero.com)

Do you have a property to sell? Are you looking for a property to buy?

Please let us know by using the details below or you can use the Contact Us page on our website.